Content

Washington (AP) — The fresh Biden government really wants to generate domestic a house transactions more clear by the unmasking the owners out of particular all-cash requests. It’s part of a continuing energy to battle currency laundering and you can the brand new path out of filthy money through the Western economic climate. Company of the Treasury and you will condition financial authorities to include the subscribers that have a safe, safe payment provider. The organization features published the fresh ties, funded the bucks reserves, used currency laundering recognition possibilities, dependent OFAC tests, and done the brand new financial controls and economic audits to run while the a non-bank financial institution.

Starting out inside the commercial home

For those who wear’t has a bank checking account, go to Internal revenue service.gov/DirectDeposit for additional info on where to find a lender or borrowing union that may discover an account on line. You could prepare yourself the new taxation go back on your own, see if your be eligible for free taxation preparing, otherwise hire a tax professional to arrange your own come back. A good blanket withholding certificate could be provided in case your transferor carrying the fresh USRPI provides a keen irrevocable letter of borrowing or a guarantee and you may goes into a tax payment and you can security contract for the Internal revenue service.

Buy Solitary-Members of the family House

Within the a happy-gambler.com see the site world where time things, finding the best provider can transform what you. A button downside from a great REIT is the fact it will spread no less than 90% of its taxable money since the dividends, which limits being able to reinvest profits to have gains. This may constrain much time-term money love than the almost every other brings. Another option to possess investing residential REITs is to spend money on an enthusiastic ETF one to invests inside residential REIT carries.

Another sort of money gotten by a different bodies are at the mercy of part step three withholding. A protected expatriate need given your with Setting W-8CE notifying your of their shielded expatriate condition and the reality that they may end up being subject to unique tax legislation in accordance to particular issues. “Willfully” in such a case form voluntarily, consciously, and you may purposefully. You’re pretending willfully for many who pay most other costs of your organization instead of the withholding taxes. Such as, if a trust pays earnings, such as certain kinds of pensions, extra jobless spend, or resigned shell out, as well as the people to possess which the assistance have been performed doesn’t have judge power over the brand new commission of the earnings, the fresh trust ‘s the workplace.

Commercial assets fund is pretty strict and may also want that you tell you a confident track record having domestic a home first, towards the top of placing more cash down. It’s along with a good riskier money, since it can be harder discover tenants, and you will industrial services are more likely to become impacted by worst economic climates. Most people trying to find pupil a home paying begin with house, and justification. The newest barrier to entry is leaner both financially plus words of expertise peak. Off costs is actually notably quicker, and you will specific consumers can even qualify for deposit assistance programs one aren’t readily available for commercial a property. What’s more, it’s usually in an easier way to be eligible for home financing than simply a commercial mortgage loan.

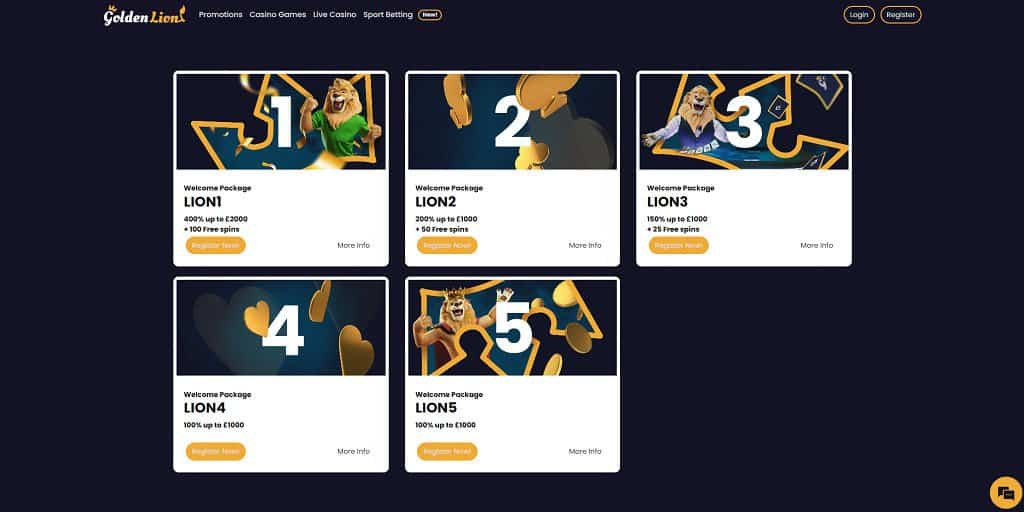

There needs to be a balance between what’s offered because the a bonus and all you have to do in order to change you to definitely added bonus for the real money. I Number Precisely the Registered OperatorsAll poker sites the next features been registered and you may certified by the appointed jurisdictions and you can government, encouraging the security, legality, and you can fairness of those internet sites as well as their poker game. Also, i check out the history of those sites to make sure participants are content to your features considering and you may medication. Just once we ensure that the web site presses all of the proper packages do we establish they right here.

Withholding international partnerships and you can withholding overseas trusts commonly move-due to agencies. A great payer documents an income tax return on the Function 945 to declaration copy withholding. A great You.S. partnership is to keep back when one withdrawals that come with quantity susceptible to withholding are made. You might change vacant room oneself possessions on the leasing spaces called accessory dwelling equipment. By upgrading your basements, forgotten, and other area for the an excellent livable unit, you could potentially draw in rent-using tenants. You additionally can be generate a visitor household since the an enthusiastic ADU if you have got enough free space for the assets you already own.

Genisys Credit Connection *

Treasury was also accountable for doing other openness-associated effort, like the rollout out of another databases on the small business possession. The brand new therefore-called beneficial possession registry is anticipated in order to include information that is personal for the the owners of at least 32 million You.S. businesses. One study from the brand new feeling of money laundering to the home values within the Canada, presented because of the several Canadian academics, found that currency laundering funding inside the a house pressed right up property costs in the directory of 3.7% to 7.5%. A home is a commonly used auto for the money laundering, on account of opaque reporting laws and regulations to your sales.

Enterprises from the home business is to plan the new execution of this latest code by the looking at their most recent AML practices, identifying positions that will result in reporting financial obligation, and starting ways to comply with the fresh requirements. FinCEN features awarded Faqs to help stakeholders navigate the new rule’s complexities. Because it is supported by physical, direct a house as well as sells smaller dominant-agent disagreement or the the quantity to which the interest of the trader is based on the fresh integrity and you can competence from managers and you may debtors.

But with all the various claims enabling additional operators, something could possibly get a tiny messy to the inexperienced web based poker people in the usa. Such as regular dividend-spending brings, REITs try a solid financing to own traders whom seek typical earnings. For the in addition to top, while the possessions starts presenting cash, it could be leveraged to locate much more assets. Gradually, the fresh buyer can obtain plenty of income avenues of numerous characteristics, offsetting unforeseen costs and you will losings that have the brand new money.

Unsecured Business Financing

A battled in the 2008 financial crisis, and noted REITs responded if you are paying of personal debt and you will re-equitizing the equilibrium sheets because of the attempting to sell stock for money. Noted REITs and you can REOCs raised $37.5 billion within the 91 additional security products, nine IPOs and 37 unsecured debt offerings because the traders went on to help you work favorably to help you enterprises strengthening their equilibrium sheets after the borrowing crisis. A collaboration is an excellent “resident” out of Maine when the at the very least 75% of your ownership of these relationship is actually held by Maine citizens.

A U.S. trust is needed to keep back for the count includible in the gross income of a foreign beneficiary on the the amount the fresh trust’s distributable net gain includes a price subject to withholding. To your extent a You.S. faith is needed to spread an amount susceptible to withholding however, cannot in reality distribute the total amount, it should keep back to your overseas beneficiary’s allocable show during the time the funds is needed to be stated for the Mode 1042-S. When the a cost susceptible to part step 3 withholding is also a good withholdable fee and you will chapter 4 withholding is actually applied to the fresh percentage, no withholding is necessary less than chapter step 3. Sobrato been attempting to sell house in the Palo Alto since the students at the Santa Clara College, ultimately getting into developing commercial functions alongside his mom prior to founding the newest Sobrato Team inside 1979.